Infrastructure systems must become resilient against climate change if they are to be sustainable. Owners, operators, and investors need to have confidence that infrastructure can withstand and recover from the extreme weather that is becoming increasingly frequent, in a way that minimises disruption and repair costs and protects its performance. Users need to know that they can rely on the vital services these systems provide. And yet, investment in infrastructure resilience lags well behind what is needed. Part of the reason for this has been a lack of evidence about where and how to invest. But this is now changing, with tools and data available to help measure and manage risk.

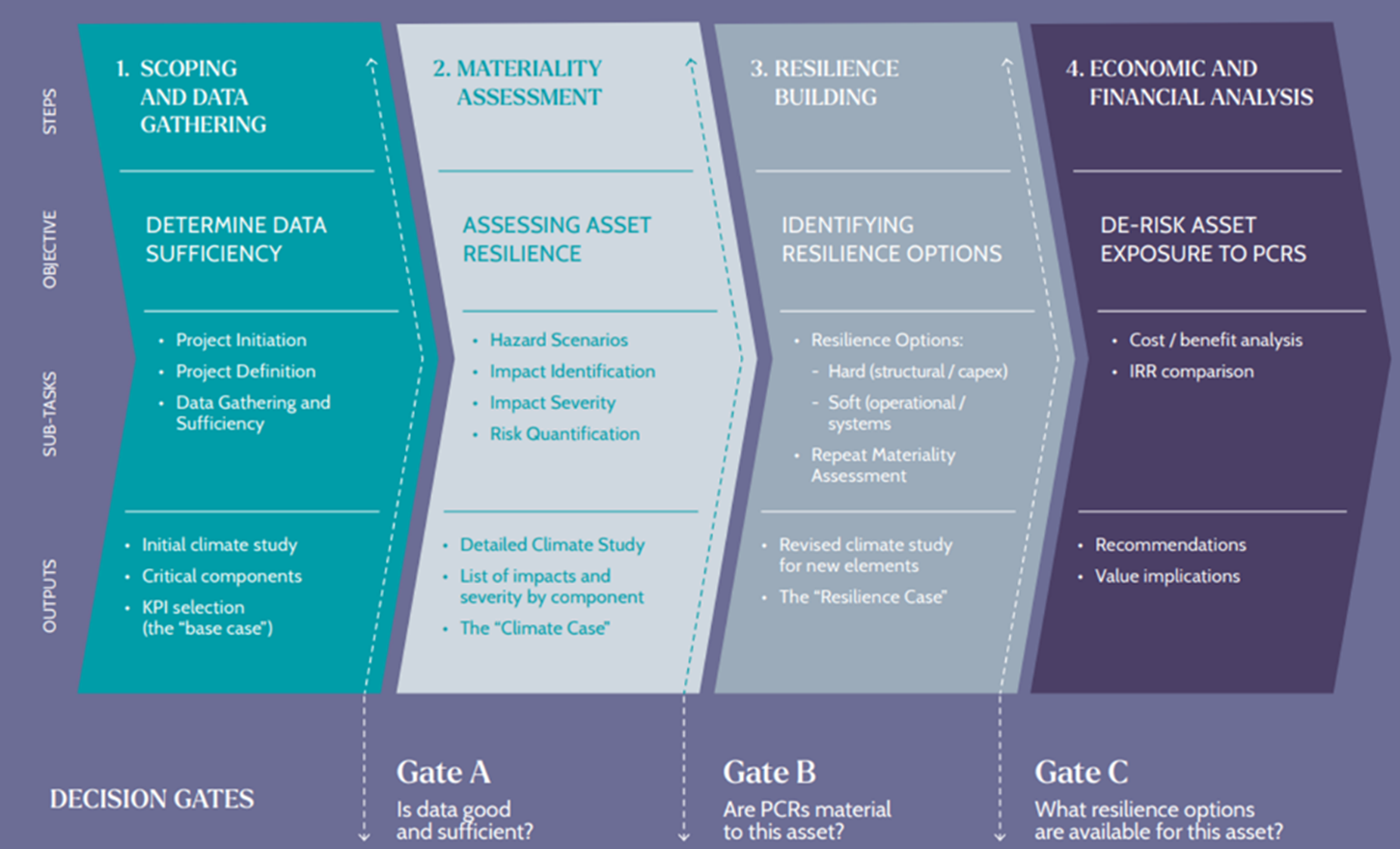

The Coalition for Climate Resilient Investment’s Investor Solutions workstream aimed to build the financial case for resilient investments. The result is PCRAM, which is an open-source resource created for the public good, to improve consistency in risk assessment and provide a common language between the infrastructure and financial industries. PCRAM is the first methodology of its kind, developed using real world case studies and rigorously reviewed by leading experts from a range of industries.

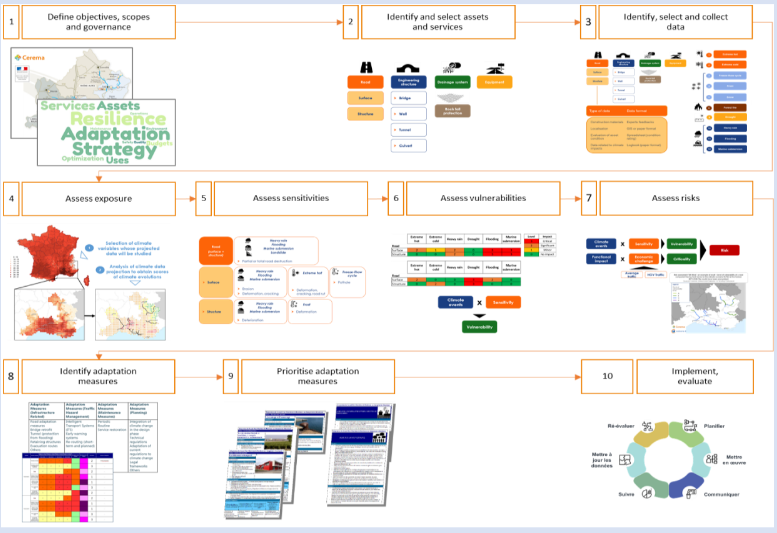

PCRAM brings together climate science, asset management, resilience practitioners and financiers to assess, design and quantify the resilience needs of infrastructure assets. It can be used to identify material physical climate risks to an organisation’s assets and build resilience to improve performance and protect revenue. PCRAM helps decision-makers understand benefit-to-cost ratio, target investment, and plan programmes of investment that align with existing organisational and regulatory investment cycles. The methodology can be applied to any physical asset or portfolio of assets, for any set of climate hazards. It is designed to enable owners and investors alike to develop their level of maturity in managing climate risks over time. PCRAM allows asset owners and operators to invest strategically and confidently to protect their assets and businesses from climate change.