Climate change, the Covid pandemic and geopolitical tensions bring into sharp focus the need to improve global resilience. Communities, companies, and countries worldwide regularly face a range of threats such as disasters and cyber breaches. The impact of these events is pushing infrastructure and resilience thresholds to their limit.

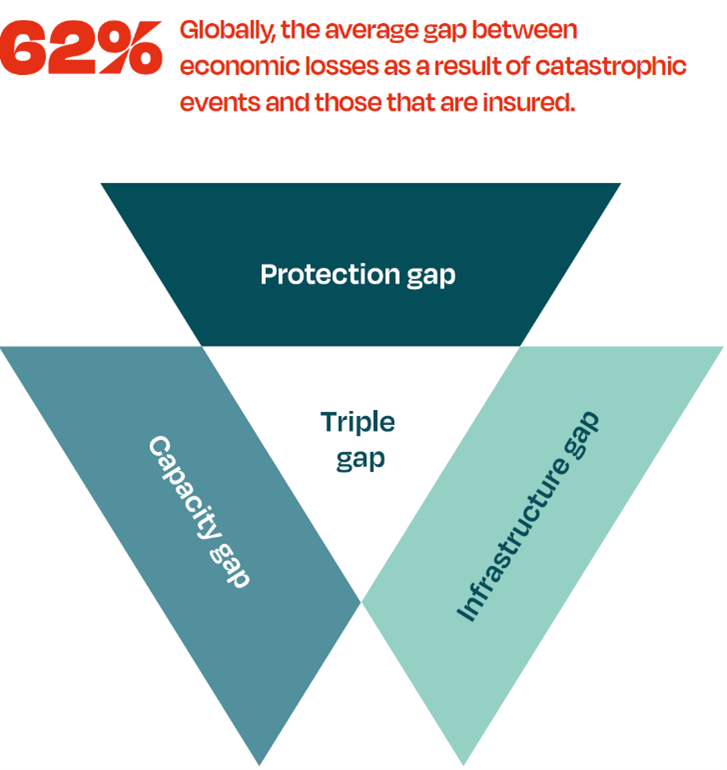

No single intervention will be sufficient to deal with the largest disasters, so a new approach is needed as a matter of urgency. It is equally essential that a combined approach to resilience is adopted to manage risks effectively and secure, for example, the maximum value from insurance which will enable averaging of costs triggered by large events, across geographies and time.

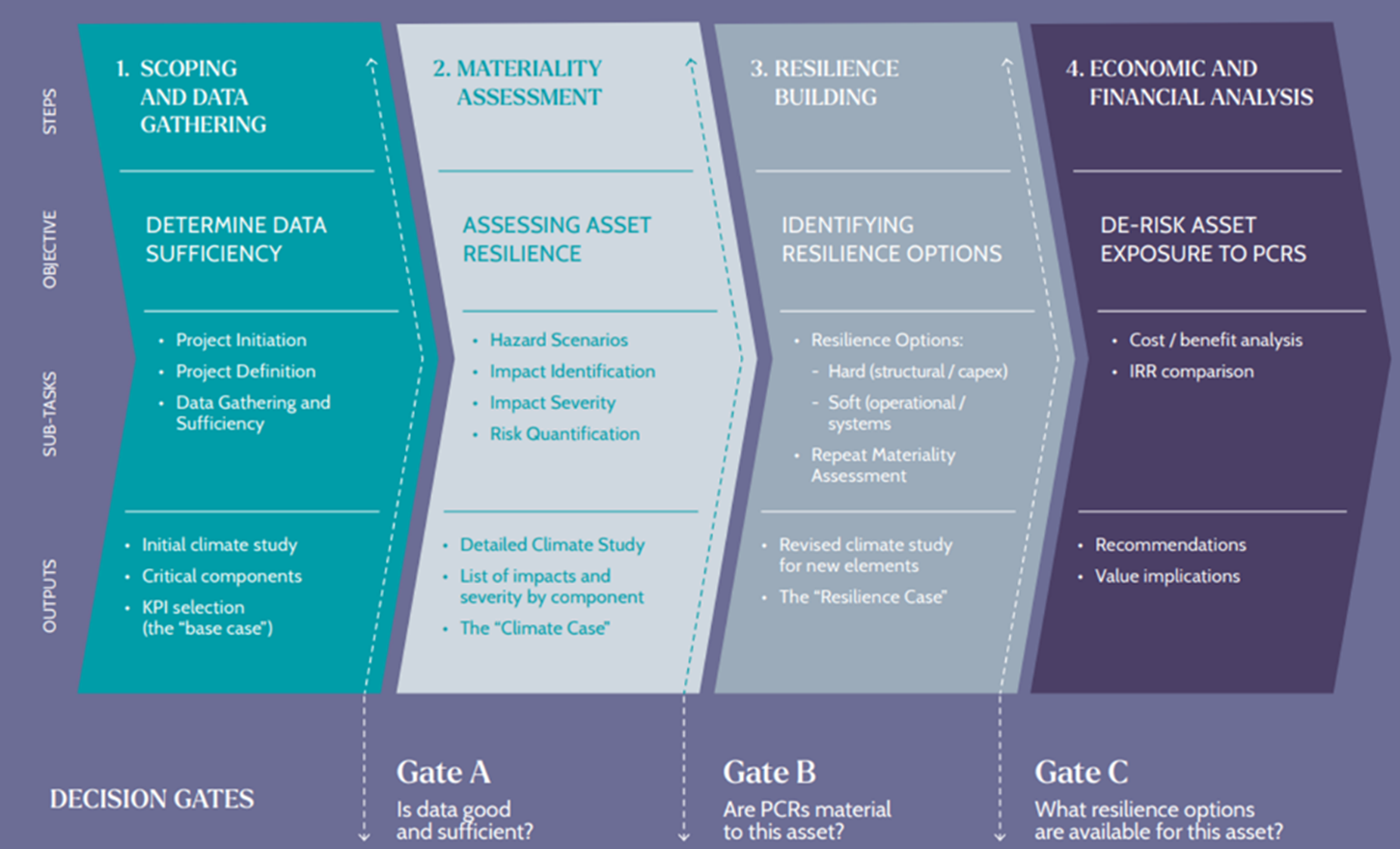

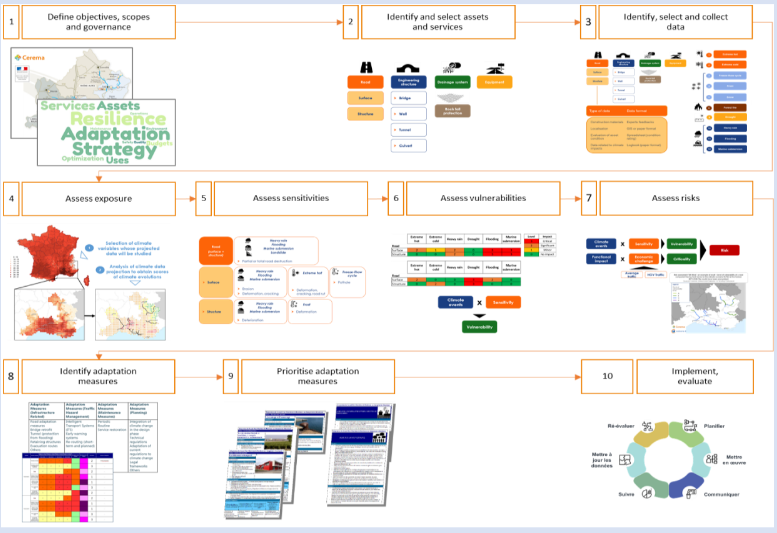

The Business of Resilience is exploring the creation of a new combined insurance and infrastructure public/private offering that has the potential to enhance how governments invest in resilience. The combination of infrastructure resilient services alongside tailored insurance and financial products, should enable governments to better invest in pre-emptive adaptation, that otherwise might have been unaffordable. These investments would potentially mitigate the risks to society and reduce the cost of expensive remediation schemes. The offer would be targeted at mitigating infrastructure risk with holistic solutions that are focused on providing and designing incentive mechanisms for risk mitigation.